Top tips for your business this new year, use this chance to grow your business, don't repeat mistakes and take...

In a perfect world, cashflow takes care of itself. All your customers pay immediately or on request, all your suppliers are happy to wait until it’s convenient for their bills to be settled and none of your essential equipment ever goes expensively wrong at the worst possible moment.

Sadly the real world doesn’t always work this way, so keeping on top of your cashflow is essential for smoothing out the financial bumps in the road. If done properly, this will ensure that when things need paying for, you’ll have the spending power to do so.

It’s been said that a lack of profit will kill your business in the end, but that it’s a slow death. Failure to properly manage your cashflow, however, will kill off your company very quickly indeed.

Quote: “Turnover is vanity, profit is sanity but cash is reality” – source unknown

Imagine a situation where your best customer puts in their biggest order ever, which will be a huge payday for the business once you’ve made delivery. However, you’ll have to make use of a temp agency for the additional manpower needed to manage this job and they insist on upfront payment, as does the supplier of your raw materials. Unfortunately, the timing’s terrible, you can’t afford either because you’ve just invested in new equipment. You can’t afford to refuse the order either because doing so would let down that customer, who might then find someone more able to service their needs, possibly never to return. This is the kind of dilemma we at Lines Henry help business owners manage on a regular basis, however, prevention is undoubtedly better than cure.

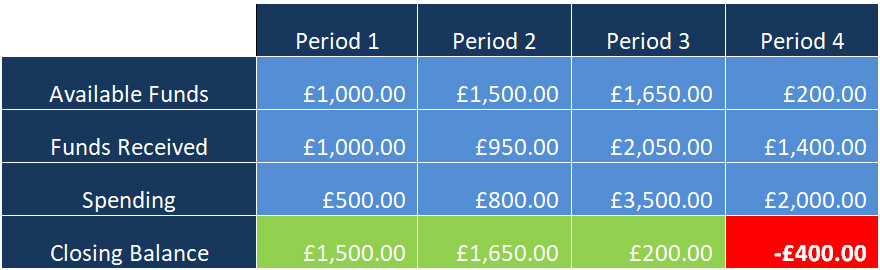

Setting up a basic cashflow forecast is fairly straightforward. Begin with the available funds you have at the start of a given period, add to that the money paid into your business during that period, then subtract from that any spending done during that same period. Ideally, this should leave you with a surplus, but whatever figure you arrive at, this is the available funds figure the next period starts with. The cycle repeats from there.

The Funds Received section covers any money coming into your business from any source, whether that be customers paying their bills, rebates received or any lines of credit. Spending, as you’d expect covers any occurrence of money leaving the company, including the purchase of supplies, payment of wages, utility costs etc.

Periods can be as long or as short as best suits your needs, from weekly to quarterly. Additionally, the ‘Funds Received’ and ‘Spending’ sections can be considered headings which you could expand to show more detail should it make sense to do so.

Where the period is in the past, you will no doubt be able to fill in your cashflow chart with fully accurate information, however, you’ll have to use your knowledge and experience of the ebbs and flows of your business to attempt to predict what will happen in forthcoming periods, which will allow you to prepare for them.

A problem shared is a problem halved and we’re here not only to share your burden but through partnership and support, help you shed it entirely. There’s no need to worry a moment longer, contact us now for a free consultation.

We’re happy to assist you in the preparation and maintenance of your cashflow, we can also advise how to optimise your internal procedures to ensure that you have the best chance of obtaining and retaining the funds you need to keep your business running efficiently.