The Amazon effect has been a hot topic amongst businesses over 2019 as the retail giant has seen massive expansion...

After the panic buying of Black Friday and Cyber Monday where businesses slash their prices (and profits) for holiday sales, we then approach small business Saturday. A day where people are encouraged to support small businesses.

This year has seen an alarming rise in company Liquidations, the big businesses like Thomas Cook have been making headline news but smaller businesses are increasingly struggling.

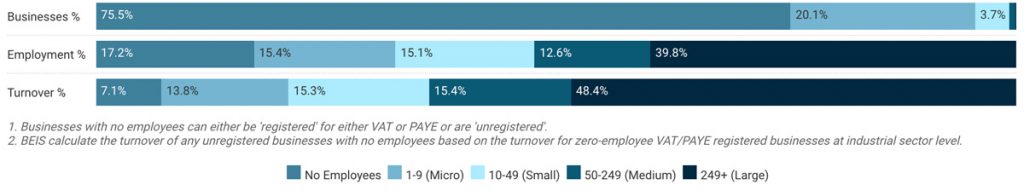

In the UK there are 5.7 million private sector businesses, 99.3% of these businesses are described as an SME, small to medium-sized business, 96% of them are micro-businesses that employ less than 9 people. This also accounts for 60% of jobs in the UK private sector.

Image from www.merchantsavvy.co.uk/uk-sme-data-stats-charts/

Small businesses do more than their fair share as employers and tax contributors and often offer real value to customers in terms of niche services or unique products. However, without the buffer of big business finance, investors, and cashflow they are often left struggling behind big businesses, losing out on the best deals and incurring penalties for overdrafts. Profit margins are often less streamlined because investment in infrastructure, training and recruitment is limited. Small businesses are often hit hardest by late payments from larger businesses, without formal debt collection or the buying power to negotiate the best contracts small businesses are often left out of pocket or struggling due to cash flow issues.

Small Business Saturday

Whilst Small business Saturday has been running in the US for a decade, it has only recently been adopted in the UK, however the scheme does work in driving sales for small businesses, according to studies on Small Business Saturday in the UK last year, SMEs took an extra £812 million, up from £748 million in 2017.

This is an amazing increase in sales and revenue, not to mention the awareness of small businesses that could gain potential customers throughout the year. SBS (Small Business Saturday) is a good incentive to buy from smaller and more local retailers, but the initiative supports all small businesses and even the B2B businesses and service industries are benefiting from this awareness day as decision-makers are made aware of smaller businesses and the value they offer.

Supporting Small Businesses

Supporting Small Businesses is essential for the local community and the growth of the economy. Employing 60% of private company workers small businesses contribute a lot to the UK, small business do need support, with larger companies having more awareness, bigger marketing budgets and able to offer lower prices through bulk buying small businesses are at risk.

One in Five Small business owners surveyed this year have warned that if they have a lower than average Christmas they anticipate liquidation or administration in the following 12 months, 8% of those surveyed are worried they may need to close in the next few weeks. This could mean a lot of jobs.

Small businesses and employers are at the heart of the community and the economy, the investment in jobs has a knock-on effect to all businesses and even public services and local communities, the UK, traditionally, has a plucky, can-do attitude which is why it is the ideal place for entrepreneurs, sole contractors and business owners to thrive, we believe in the underdog and the fight to succeed, but only if we invest in each other. Of course, big businesses have their places but small businesses prop up these large brands more than they would like to admit.

Whilst everyone says they support small businesses, the temptation of next day delivery and cheaper prices from larger companies is too much of a draw to resist.

This Saturday make sure you put your money where your mouth is, if you don’t want to buy from a business at least support with a recommendation or review.

We speak to a lot of small businesses who come to us for rescue and recovery advice and we understand the hardships small businesses face, if you are feeling like you may not make it then speak to us sooner rather than later, the sooner you come to us for recovery advice the more options we have to help.